LINKS

PM_SPOTS

LATEST_POSTS

CME Group (Chicago Mercantile Exchange) brought the entire futures universe to a standstill just as banks tapped a staggering $24.4 billion from the Federal Reserve’s Standing Repo Facility—

all during a thin, half-day holiday session when the real action should have been months away from typical quarter-end stress.

The shutdown spanned FX, Treasuries, equity indexes, and crucial metals contracts like silver, locking out traders everywhere while price discovery went dark.

SAM Precious Metals, one of the Middle East’s leading accredited precious-metals refineries, has produced the world’s largest silver bar –

an extraordinary Guinness World Record-breaking creation weighing 1971 kgs, reflecting the UAE’s founding year and engraved with the map of the country.

The bar was unveiled at the Dubai Precious Metals Conference 2025 (DPMC),

where it immediately drew global attention as a landmark achievement for the region and a striking demonstration of Dubai’s expanding capabilities in regulated precious-metals innovation.

When the world’s largest creditor stops subsidizing everyone else’s debt, the entire

architecture of global finance must be rebuilt. That moment arrived on November 10, 2025.

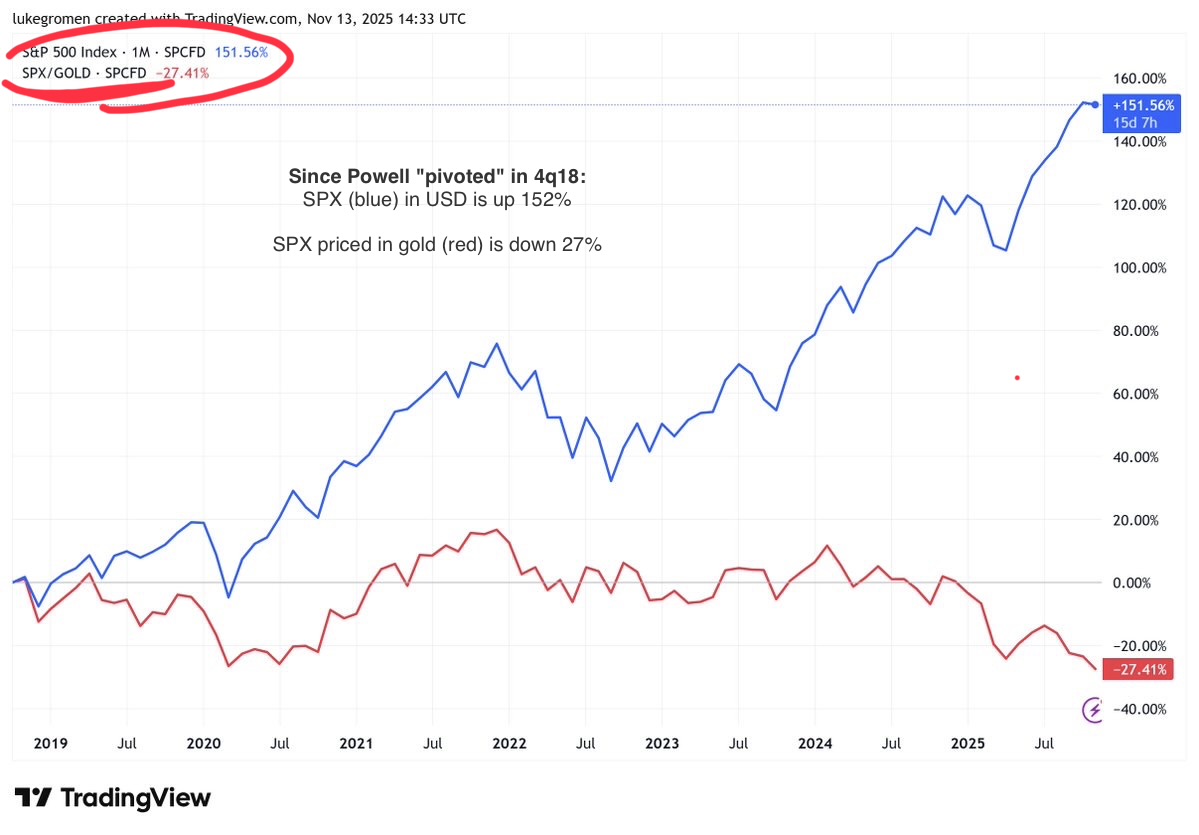

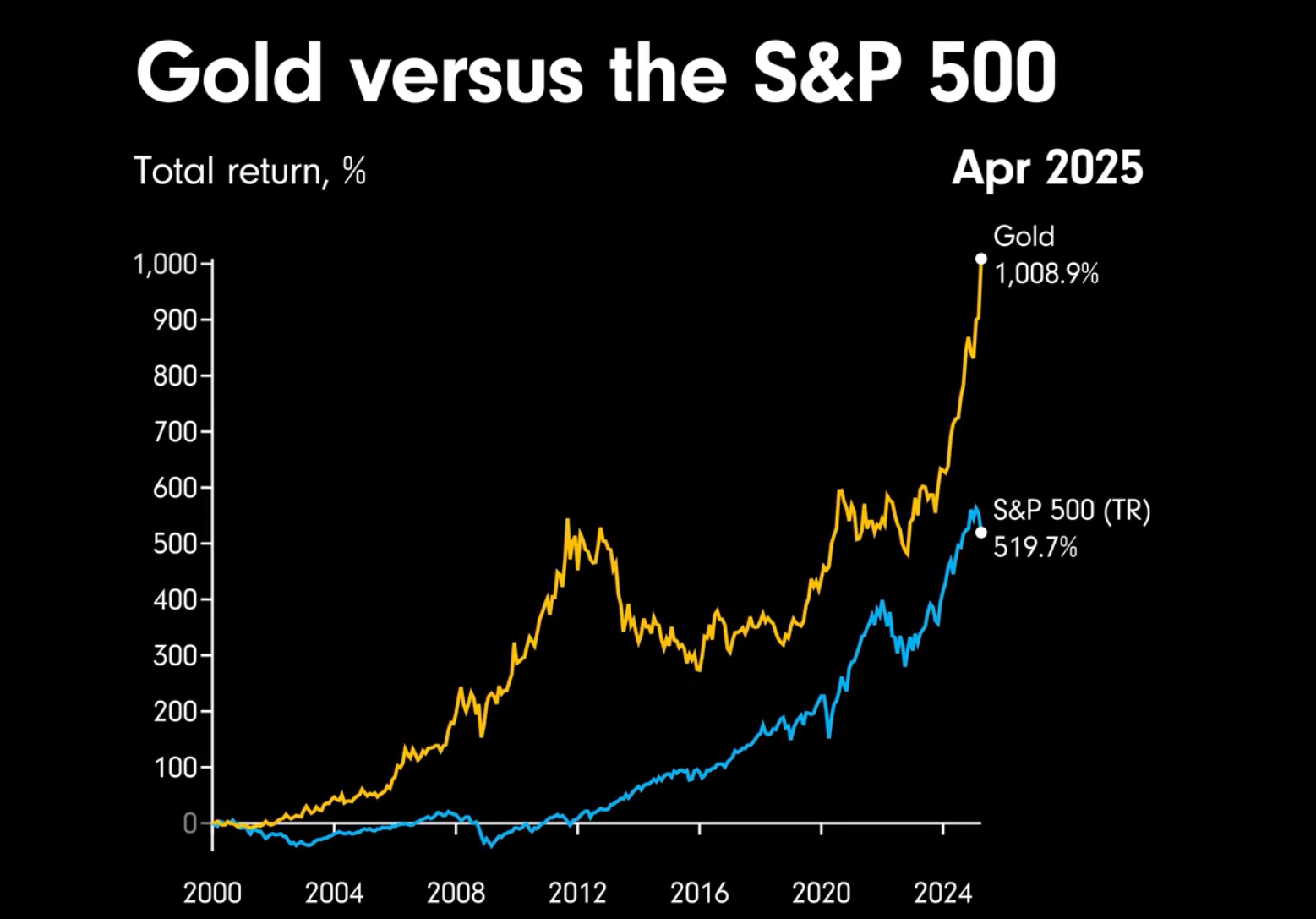

The return of the S&P 500 priced in USD or Gold

Luke Gromen, November 13, 2025

”China’s silver export ban exposes the West’s hollow paper markets just as Washington prepares to call silver “essential.”

Perfect timing: the nation that offshored industry now finds itself resource‑starved.

The empire of IOUs meets physical reality—America can declare Silver essential… Yeah that Silver, the one thing it no longer controls.” - Jon Forrest Little

Silver has experienced three spectacular bull runs over the past century, each driven by distinct macroeconomic, geopolitical, and supply-demand dynamics.

Yet the present cycle is fundamentally different—a convergence of global mining stagnation and surging multi-sector demand

threatens to ignite a much more consequential and potentially prolonged price explosion.

1913 was a terrible year for America and human freedom.

It was the year US Congress passed the Federal Reserve Act and ratified the 16th Amendment to the US Constitution, which authorized a federal income tax.

At first glance, these two unfortunate developments may seem unrelated. Yet what are the odds that the US would adopt both a central bank and an income tax in the very same year?

There is a saying about political struggle: "First they ignore you, then they laugh at you, then they fight you, and then you win."

The Gold Anti-Trust Action Committee, gets the point about struggle.

When GATA began 27 years ago central banks were furiously attacking gold with sales, leases, and derivatives, and gold was going down.

Now many central banks are furiously acquiring gold, and gold is going up. But the same principle is at work,

the principle articulated in Secretary Kissinger's office back in 1974: Control of gold is control of the world.

Without raw materials and creative innovations, there is neither progress nor prosperity.

Recently, El-Erian posted a tweet that caught the attention of Bloomberg analyst John Authers:

"What if stock-market gains were measured in gold instead of dollars?

As John Authers notes, U.S. stocks denominated in gold have been in decline since the dot-com bubble burst 25 years ago.

Stocks elsewhere have done even worse."

The London silver market seized with no silver liquidity at one point on Friday October 10, 2025 indicating the ‘free float’

of silver available to market in London is effectively near zero despite large vault holdings of silver there.

There is now a global shortage of physical silver while there are billions of oz. of cash promissory note contracts of immediate ownership and immediate

delivery of silver extant in the London market.

And the veil has now been lifted on the London promissory note cash silver market that will induce further holders of these contracts to demand immediate delivery.

The world’s richest nations are out of fiscal options. Even The Economist now admits debt can’t be repaid and growth won’t fix it.

When governments inevitably inflate away currencies, it is a straight-up admission that our 'public' debts have us all in checkmate.

When trust itself is at risk, only one asset has held both global trust and value for five thousand years.

For several days now, the financial markets have given the impression of order and recovery.

However, all signs indicate that the system is being propped up by increasingly precarious artifices.

A market that trades twelve times its own value in twenty-four hours is no longer a market:

it is a closed circuit, fueled by mirror trading and automated wash trades.

Behind these superficial manipulations lies a much deeper structural imbalance:

the dominance of fiscal policy over monetary policy – in other words, fiscal dominance.

Commodities have grown into their own legitimate and respected asset class.

This book "Commodities For Dummies"(2023) 3rd Edition, is to offer you a comprehensive guide to the commodities markets and show you a number of investment strategies to help you profit in this market.

You don’t have to invest in just crude oil or gold futures contracts to benefit.

It was the most glorious example of Uncle Sam shooting himself in the foot—and not just once, but point blank, both barrels, on the world stage.

Executive Order 14024, signed in 2022, was hailed in Washington as a “strategic triumph.”

That single piece of paper—Executive Order 14024—was supposed to punish Moscow. Instead, it punished the dollar. The world started escaping America’s financial reach.

And what asset can’t be frozen, hacked, canceled, or sanctioned? Gold.

Apparently broader confidence in the global financial system seems to be weakening further, in a world of weaker growth and rapid rising debts.

When monetary expansion significantly outpaces productive economic growth, the value dilution becomes evident.

Gold just shattered the $4,000 barrier—a milestone decades in the making.

Yet beneath the celebration lies a far darker reality: a $300 trillion global debt bomb and a deliberately rigged dollar system that’s reaching its breaking point.

For centuries, collapsing empires have chosen the same escape route—currency debasement to monetize debt. The U.S. is now following that script to the letter.

When paper lies multiply, real metal wins. Seize the impending breakout before the masses wake up.

Global silver markets are approaching a critical inflection point as the disconnect between paper and physical silver reaches extremes not seen before.

According to the latest data from the London Bullion Market Association (LBMA),

free-floating inventories have plunged to just 135 million ounces — roughly half of the market’s daily trading volume.

In Ray Dalio's newest book, How Countries Go Broke he describes the process by which societies create credit, then misuse it, and ultimately liquidate it.

He shows through historical examples a repeating process that typically takes about 80 years to unfold.

Ray's "Big Debt Cycle" resembles those of others like Neil Howe, Peter Turchin, Martin Gurri, and George Friedman.

Despite different starting points, they all conclude a crisis period is either approaching soon or already underway.

Industrial demand for silver is experiencing a historic boom, especially with China’s dominance across solar manufacturing, AI deployment, and auto production (including EV giants like BYD).

Now China's $100/oz sudden freeze on all on-the-spot silver trades and fund subscriptions unleashes a supply deficit.

Forget what economics textbooks taught about supply and demand—the silver market is entering the realm of the "Giffen good".

Normally, rising prices put off buyers, but right now, every dollar higher brings a new wave of desperate investors storming the gates.

Silver’s bull run isn’t just strong—it’s rewriting the rules.

For decades, the 60/40 portfolio — 60% stocks and 40% bonds—set the standard in institutional investing.

Gundlach recently forecasted that gold could hit $4,000 per ounce before year end,

suggesting that even a 25% gold weighting in portfolios is not excessive in the current environment.

Both institutional and retail investors are headed for safety: allocations to gold are at multi-generational highs,

and market forecasters are openly talking about gold prices the likes of which haven’t been seen since the 1970s.

Gold’s latest ascendancy is more than a bull run—it’s a global indictment.

Fears of runaway US debt, US policy, trade wars, and eroding dollar confidence are driving investors from Treasuries—sparking a rush for gold’s safety and gold drags her little sister silver along.

Washington’s real play now is a shift to stablecoins “backed” by Treasuries.

How to Listen When Markets Speak

Lawrence G. Mcdonald - A bestselling author and leading expert on market risk

From Wall Street to the White House, the fantasy of an eventual 'return to normal' is still alive and well, nurtured by dangerously outdated theories.

But the economic world as we know it and the rules that govern it are over.

In the coming decade, we will witness sustained inflation, a series of sovereign and corporate debt crises,

and a thundering of capital out of financial assets into hard assets and few are prepared.

In the past few months Chris Marcus of Arcadia Economics has been working on a silver report,

with the goal of providing an overview of the market, what's led us here, what to expect going forward,

and some of the important yet rarely addressed questions that have been left unanswered.

The report further discusses persistent silver market deficits, why they are likely to continue or worsen,

and why silver has underperformed gold during recent rallies, even at higher prices.

The single most important chart in the world is flashing “-DANGER- ”.

To be clear, the U.S. has had a debt problem for years.

That’s nothing new. What IS new is that the bull market in bonds, the macro setup that allowed the U.S. to issue all this debt is OVER.

This is THE most important chart in the world. It’s a chart of the 30-Year U.S. Treasury.

William Strauss and Neil Howe's generational theory, first articulated in their 1991 book "Generations" and refined in 1997's "The Fourth Turning,"

posits that history moves in cycles called "saecula".

Each saeculum lasts approximately 80-100 years—the span of a long human lifetime—and contains four turnings of roughly 20-25 years each.

These turnings are like seasons: Spring (First Turning/High), Summer (Second Turning/Awakening), Autumn (Third Turning/Unraveling), and Winter (Fourth Turning/Crisis).

The Fourth Turning (Crisis) brings secular upheaval—usually war or revolution—that destroys the old order and creates a new one.

Industrial demand is the fuel, but “monetary” mania is the match.

Here’s the rub: silver makes its craziest moves when central banks, ETFs, and anxious investors pile in as the financial world wobbles.

As both Moscow and Riyadh line up for physical ounces more will follow.

Meet David Bateman. Not Bruce Wayne, but close.

He’s the billionaire tech founder (of Entrata), and now, apparently, the newest self-styled guardian of sound money.

Bateman isn’t mincing words. He’s laying out a thesis that many gold and silver bugs have whispered for years:

the system is rigged, it’s failing, and the exit paths are narrowing.

The most significant driver of the shift to investment-grade gold is the China Banking and Insurance Regulatory Commission's (CBIRC) March 2025 mandate,

requiring insurance companies to allocate at least 1% of their assets to physical gold.

By converting dollar-denominated assets (such as U.S. Treasuries) into physical gold,

China is not only diversifying its reserves but also signaling a shift in global financial power.

If you like to educate yourself on the Trump's monetary reset topic but you don’t want to slog through

Stephen Miran’s dense 40-page white paper,

Matt Smith of International Man has already done the hard work—connecting the dots.

As he put it: “Succeed or fail, Trump’s plan will impact all of us and our investments.

I confess I’m delighted "Team Trump" sees the problem… has a plan to avoid the worst, and catapult the U.S. to new prosperity.

But what they need to do will not come without pain. A LOT of pain.”

Gold is one of the most useful metals in the world.

Due to its utility, coupled with its scarcity, gold is also one of the most valuable metals in the world.

The metal’s inherent physical and chemical properties make it useful in many industrial and technological applications.

This is why we see gold increasingly used in the tech sector.

In fact, gold would probably be used even more if it weren’t so rare and expensive.

Everything in silver is getting so, so stretched.

It's hard to imagine this game going on much longer.

Harder still to imagine what happens when it ends.

This isn’t just about silver.

It’s about fragility, exposure, and cracks in a system designed to hold -- until it can’t.

Modern Monetary Theory (MMT) is a new term (since 1993) for printing paper money out of thin air, but coin-clipping is as old as time.

In fact, a major milestone in fiat money took place 60 years ago, on June 3, 1965, when President Lyndon B. Johnson (LBJ)

wanted to push all his federal chips in on “Guns and Butter” to fund the Vietnam War to the full.

There was virtually no inflation in America’s first 150 years

but the truly rapid attack of inflation came after LBJ took silver out of America’s coins as a result of the Coinage Act of June 3, 1965.

Throughout history, the cycle of war and currency debasement has repeated itself with ruthless predictability.

The recent escalation between Israel and Iran—marked by Israeli strikes on Iranian nuclear sites and Tehran’s retaliatory missile and drone attacks—reveals a brutal truth:

war is not just about security, sovereignty, or ideology. At its core, war is a business.

'All wars are bankers’ wars — How war profiteering enslaves workers and why gold and silver offer a way out.

For centuries, gold has shimmered at the heart of human commerce.

Now, as the world teeters on the precipice of a new financial epoch, gold has reclaimed its throne,

overtaking the euro as the second-most important global reserve asset, according to the European Central Bank.

The implications are seismic: we are witnessing not just a shift in asset allocation, but a profound transformation in the architecture of global trust.

The Musk-Trump Meltdown and Silver’s Breakout, what do these two stories have in common? Both reveal a shift. One is a fracture in a powerful relationship.

The other is a breakout in a long-overlooked market. Both speak to volatility and realignment. Both challenge us to think beyond the surface.

The U.S. is losing, and losing badly, to the Global South.

Evidence is that in the current economic turmoil, the dollar is being shunned while gold has been surging.

In other words, in contrast to previous periods of turbulence, gold and critical commodities have replaced the dollar and dollar bonds as the shelter of choice.

I’m not giving up on America, but I’m hardly optimistic.

Pessimism is justified because there seems to be no recognition of the problems, more than half a century in the making, that have led to our decline.

For a democracy to be great, it must see that the key distinction isn’t between dullards and geniuses.

Rather it’s between those with true freedom of thought and those who blindly follow the herd, via Twitter and its ilk.

The Four Noble Truths of Buddhisme deal with the nature of suffering, its cause, the possibility of its cessation, and the path to achieve that cessation.

In this article we look at the five noble truths in our society and the possible cessation of the class divide coming from owning silver and gold.

Silver investors are usually interested in which countries produce the most ounces of the metal.

However, it’s also worth looking at silver reserves, which are a country’s economically mineable silver supply.

This overview of top silver countries by is based on the US Geological Survey’s most recent data on silver.

The United States has crossed a Rubicon of fiscal credibility.

Moody’s historic downgrade of America’s credit rating from Aaa to Aa1 isn’t merely a technical adjustment-it’s a flashing red siren about a debt crisis.

The Federal Reserve also recently made a stealthy return to quantitative easing, buying $43.6 billion in U.S. Treasuries over four days without public attention.

This "stealth QE" is seen as a quiet monetary easing rather than normal policy, signaling concerns about financial stability.

The "In Gold We Trust Report 2025" is here called - The Big Long -

Ronald-Peter Stöferle & Mark J. Valek, May 15, 2025

The world's most anticipated gold market report has just (15 may) been released, the In Gold We Trust report 2025 – The Big Long.

Almost 500 pages of ready knowledge and specialist experience.

After "the tour de force" through the diverse gold universe, Ronnie and Mark sincerely hope that you enjoy reading their #IGWT25 as much as they enjoyed creating it!

Conclusion: Gold is unique in the financial system, it is establishing itself as a neutral, liquid, and counterparty-free anchor of confidence and thus

as a possible cornerstone for "Bretton Woods III". Also Gold has proven to be a reliable hedge in past recessions and bear markets and diversifies the

portfolio in adverse scenarios such as high inflation and stagflation.

Call it "Chinese Food" for thought, consumption, or sentiment adjustment, but the fact that the Chinese have thrown a peace offering

at the Trump administration is a testament to the severity of the damage to the U.S. bond market during the early April façade.

To say that tariffs are "good" for America is about as inane a comment that could ever be levied,

but what makes it even more absurd is that 100% tariffs levied on April 7 were great,

but the revisions down to 10% tariffs this week are now perceived as "even greater."

The Trump administration seeks to restore dollar hegemony and the re-shoring of US manufacturing through intentional policy shocks.

Like 1971, DC still thinks it can run a world wherein it’s “our dollar, and the rest of the world’s problem”.

But in the backdrop of a rising BRICS, clear de-dollarizing trends, central bank gold stacking, gold’s Tier-1 status at the BIS,

a drying COMEX, IMF gold telegraphing, a neutering petrodollar and failed US Treasury auctions,

the world is no longer willing to be the dog wagged by the tail of the USD.

Gold beats the Standard and Poor's 500 over 25 years

EEAGLI, April 2025

If you’d told most investors 25 years ago that gold would trounce the S&P 500 in terms of total returns, they might have scoffed.

After all, what does gold actually do? It pays no dividend and sits in a vault, yet somehow,

over this period, it has produced eye‐watering gains that have eclipsed America’s most famous equity benchmark – the Standard and Poor's 500 stock index.

That is the story behind this data visualisation, especially astonishing if you fancy yourself as an aficionado of index investing.

The price of silver today sits at $33 per ounce-33% below its 1980 inflation-adjusted peak of $50. Meanwhile,

the U.S. money supply has exploded from $1.5 trillion to $21.5 trillion.

What other critical asset remains shackled to 44-year-old prices while currency debasement runs rampant?

In truth, Fort Knox holds the world’s largest pile of stolen gold—a hoard the US

government obtained through confiscation, forcibly taken from private citizens.

For decades, this gold has been shrouded in secrecy, with no full assay or

independent audit ever conducted to verify its existence or purity.

The real story of Fort Knox isn’t one of security, but of financial theft on an

unprecedented scale—and quite possibly, an ongoing fraud that persists to this

day.

Most people think gold is just an inflation hedge. They’re missing something bigger: Gold is becoming Tier 1 collateral again. And that changes everything.

This shift to gold as Tier 1 isn’t happening in a vacuum. It aligns with broader global financial restructuring under frameworks like Agenda 2030 and Agenda 21.

You may not see the connection yet. But the dots are real—and they’re deliberate.

The data I'm about to share shows silver is nearing another turning point—one that could match today’s best opportunities.

The most reliable signal in silver's history has just appeared again. Silver’s 100 to 1 Activation Point Just Triggered.

Gold may be the crown jewel of precious metals, rising during economic uncertainty, but silver has repeatedly proven itself to be the underdog ready to take the throne.

History reveals a compelling trend where silver, initially lagging behind gold during its surges, catches up with dramatic flair, often delivering returns 2 to 5 times greater.

While the U.S. accuses the world of unfair trade practices, history reveals that it has long wielded its "exorbitant privilege"

as the issuer of the global reserve currency to extract wealth from other nations.

Over the last 50 years, America has consumed approximately $46 trillion more in goods than it has produced, financed by issuing debt denominated in dollars.

This system allows Americans to enjoy cheap imports while other nations toil in sweatshops producing goods for a currency that can be devalued at will.

Market analyst Paul Brownstein argues that the gold price isn't being suppressed by central banks anymore as much as "guided" to its return to an important place

in the world financial system. He writes: "Insiders aren't waiting. They're accumulating real assets while paper confidence holds.

Physical gold is moving. Sovereigns are repositioning. The window to reposition is closing.

Gold's role is shifting from a relic of the past to a pillar of the future.

Let’s be clear about this: no large holder is dumping physical gold and silver bars.

The sell-off is the product of managed money - hedge funds, CTAs and other institutional pools of capital

- puking their egregiously big long positions in Comex futures

while the banks sit back and ring the cash register as they cover their egregiously large short positions.

Warren Buffet's three Critical silver signals are "massive and ongoing deficit", "stagnant supply" and "plummeting stockpiles".

All three of these indicators are perfectly aligned and a fourth one is in play no one saw coming (solar demand).

Which means another billion-dollar opportunity is right in front of you, but not for long.

Many precious metals investors have heard about silver manipulation or suspected it, but few fully

understand how it works or can clearly explain it. Many also intuitively sense that silver's price is

artificially low and should be much higher but struggle to identify what—or who—is keeping it

suppressed. Find the answer here.

In the here and now, very few have “connected the dots”.

The world will move to some form of a Gold Standard, with or without the participation of the US.

Probably they (BRICS, US, Yuan) will start to do so with a gold backing of 25 to 40% of the Money Supply,

meaning $24,000/oz would be a floor for gold prices for the decade ahead.

For reasons still unclear, the U.S. has decided to clean up its balance sheet.

That means some of the gold IOUs have been called in.

The problem? Many bullion banks, complacent for years, now face a scramble.

They have far more claims against gold than they have actual gold. And with IOUs being recalled,

they’re being forced to cover their positions—at any cost.

Gold and Silver: Relative Values in the Ancient Past

James Ross & Leigh Bettenay,sep 2023

In recent months, the gold market has witnessed a significant shift with a mysterious buyer purchasing approximately 30 million ounces of gold.

This substantial acquisition has sparked intense speculation about the identity of the buyer and the underlying motivations.

As the world inches closer to a potential monetary reset, understanding the motivations behind the 30 million ounce gold purchase becomes crucial.

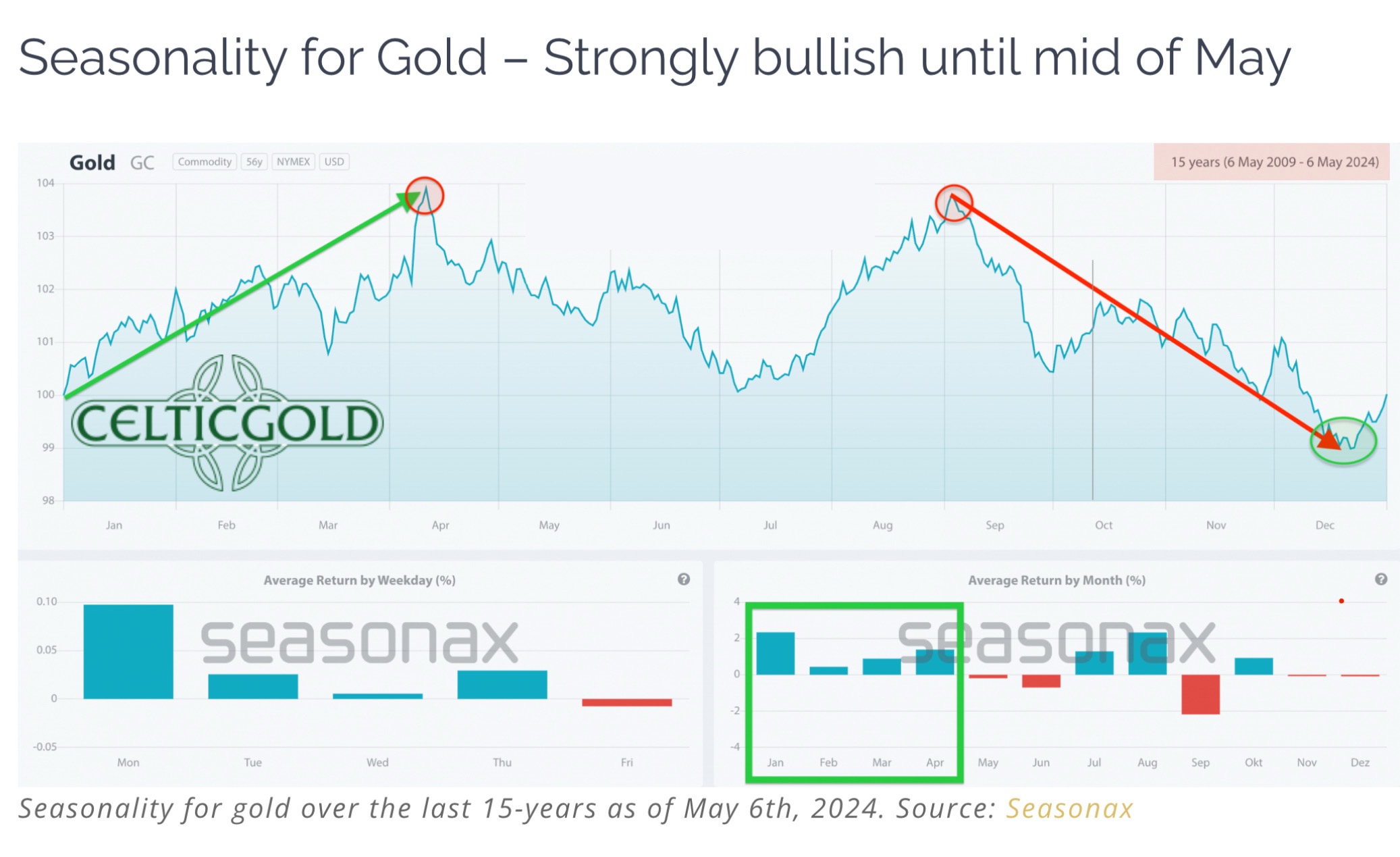

Seasonality for gold over the last 15-years

Florian Grummes, 2025

Without a doubt, the gold price is in its best phase of the year. In the past, this phase, starting from mid-December or the beginning of the year,

almost always led to significant increases lasting into spring, sometimes even extending into early summer.

For years the “poor man’s gold” or “the devil’s metal” nicknames for silver were justified by the lacklustre returns and the wild ride its price took along the way.

The devil’s metal is still not for the faint-hearted. But it has almost kept pace with gold over the past year and has outperformed it over the past five.

With investment flows now following returns, a once-niche asset is inching towards the mainstream.

Investing in silver during a gold boom can be best explained by the silver leverage effect.

In the past, silver prices have risen or fallen in value by a higher percentage than gold.

Hence, when the price of gold increases, silver prices tend to increase by a much larger proportion.

This characteristic has been leveraged by many investors who seek to make the most of silver bull markets.

The veil is slipping.

Gold and silver investors should be ready for some interesting revelations and, perhaps, changes in the metals markets.

They should also beware of "experts" still clinging to conventional wisdom.

Now is the time for questions, not blind trust.

yutuwp interview with Dunagun Kaiser

In recent decades, China, which ranks fifth in global silver reserves, has not only mined 3,500—4,000 tonnes annually

but imported large quantities of silver dore for refining as well.

Less well known is the Peoples Bank's role in managing silver reserves,

which is still regarded in China as a monetary metal. China was on a silver standard only 90 years ago.

LBMA Offered to Censor BullionStar When BullionStar repeatedly called on the LBMA to uphold its own mission –

reforming for integrity and tranparency in the precious metals market – how did LBMA respond?

Controlling the narrative!

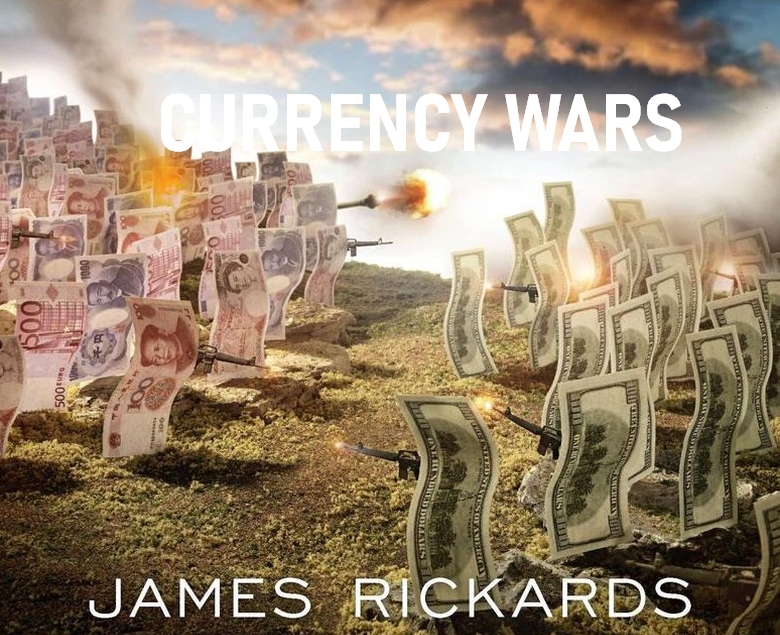

Jim Rickards’ best-selling 2011 book, Currency Wars, was prophetic.

He painted a stark picture of the flaws in the modern paper monetary system, warning that “a new crisis of confidence in the dollar is on its way.”

Although the U.S. dollar has been strong against most other paper currencies for years, it has weakened dramatically against gold.

Demand for gold has been far outstripping the supply for many, many years now.

And as we’re taught in Economics 101 textbooks, when demand outstrips supply, prices go up.

But that hasn’t been happening with the gold price until just the last few months.

And the question is, why hasn’t it happened?

Many writers have hypothesized the end of the LBMA paper gold manipulation and a real revaluation of the yellow metal.

Paper claims, they said, were worthless representations of real money, and would collapse in value as capital flies into gold,

rocketing the price upwards by hundreds of percent. This ponzi could only end in disaster,

they said, and gold would return to its rightful status as a global reserve currency.

Is their theory finally playing out?

Silver appears to be poised for an overdue rally, supported by strong industrial demand,

persistent supply deficits, and the potential for increased institutional adoption. While risks such

as trade disputes and policy shifts remain, the fundamental outlook remains constructive, and

we believe this sets the stage for silver to outperform gold in 2025.

The tariffs on gold and silver imports from Mexico and Canada will have far-reaching consequences.

A 25% tariff on gold imported from Mexico or Canada will therefore add $700 per oz to the international gold price,

assuming a $2800 gold price, and leave the final price post tariff at a staggering $3500 per oz.

Retired Sprott executive Kevin Bambrough yesterday recounted how bullion banks long have made a habit of selling metal they don't really possess.

His story begins: "During my tenure at Sprott (2002-2013), we had accumulated a significant position in silver in the 2005-2007 period.

This was done via top-tier bullion bank certificates that promised five-day delivery.

What unfolded next exposed a troubling reality about the paper silver market and, I believe,

led to the huge run in silver that followed as it ultimately ran to its all-time high in nominal terms. ..."

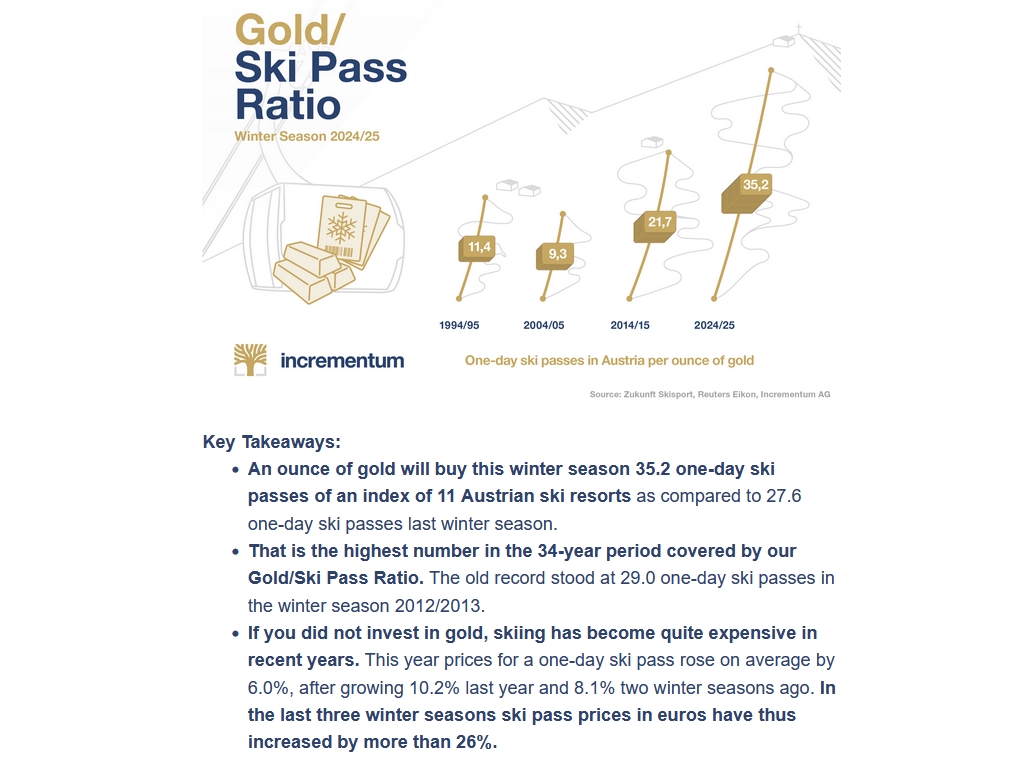

IGWT_Spezial_2025_Gold_Skiticket_Ratio

Incrementum, jan 2025

GOLD & SILVER:THE GREATEST BULL MARKET HAS BEGUN

JORDAN ROY-BYRNE, jan 2025

A freebook from JORDAN ROY-BYRNE of "TheDailyGold.com". Learn more about "A ONCE IN A LIFETIME INVESTMENT OPPORTUNITY". Over the past 100 years,

the best indicator of the trend in the Gold price has been the trend in real interest rates, which is essentially interest rates minus the

inflation rate. Gold will rise when real rates are negative or decline towards negative territory.

- Older Posts -

Physical gold and silver remain THE ONLY reliable hedges against reckless and untrustworthy governments and bankers.

Whilst bonds are the barometer of trust and faith in a system, gold is the talisman of fear

In nature everything is connected, everything is interwoven, everything changes with everything, everything merges from one into another.

This observation, more than ever, applies to the current gold market.

Very few people today think about the sustainable value of all their various baseless fiat currencies.

(Lee Quaintance & Paul Brodsky)

HOME

HOME

FAV_COMPS

|